Nibble launches debt investments

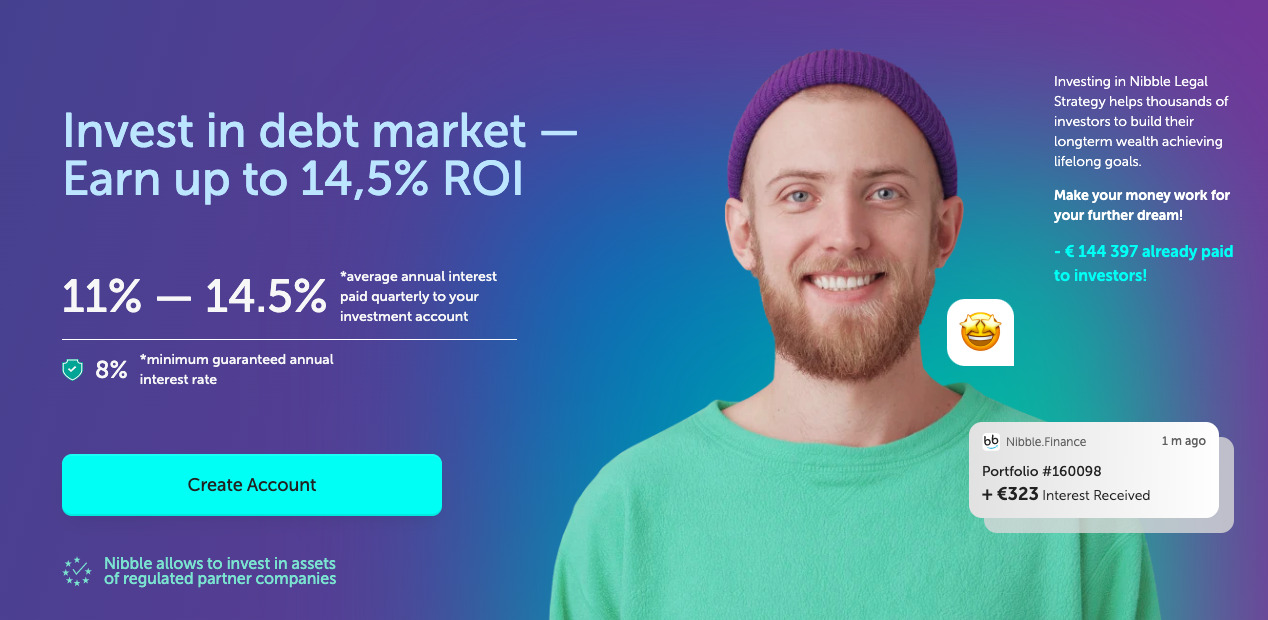

European investment platform Nibble is launching a new product: Legal Strategy. This gives private investors the opportunity to invest in debts. According to the platform, it offers a minimum guaranteed annual interest rate of 8 percent.

Nibble is an investment platform from Estonia where users can invest in loans. The loans are issued by companies joint under Joymoney and within IT Smart Finance holding. Nibble is part of this holding and acts as a link between investors and lenders.

Nibble wants to make debt investing accessible with Legal Strategy

Now, the platform is expanding its suite of investment opportunities. The market of debt investments is usually not very accessible for private investors, but Nibble wants to open it up with Legal Strategy. Users can now invest in portfolios consisting of consumer loans.

Yield can reach up to 14.5%

According to the platform, all assets are covered with a minimum 8 percent deposit back guarantee. This is the obligation of an agency to return the full investment amount at the end of the investment period, while ensuring a minimum yield of 8 percent per year.

The loans in these portfolios have overdue debts and fines, which means that the yield can reach up to 14.5 percent per annum. Users should be aware that the minimum investment period is from 6 to 12 months. Because each portfolio consists of a large number of loans, the risk of not receiving income from several contracts is reduced as they are covered by other loans.

Investing possible from €50 to €10.000

Users can choose a portfolio and invest an amount from 50 to 10,000 euros monthly. The platform does not charge a commission for transactions. During the fundraising process, the 8 percent interest is accrued daily.

Afterwards, investors continue receiving interest daily at a rate of 8 percent per annum. Additionally, every 90 days, the platform calculates the actual yield of portfolios and transfers the difference between the guaranteed interest and the actual rate of up to 14.5 percent to the investors’ accounts.

In collaboration with Boostr

“We believe that debt investing is a smart strategy to diversify any investment portfolio. Legal Strategy will be a game-changer for our investors, providing them with a reliable and stable source of passive income in the highly volatile world of crowdlending. We look forward to seeing the positive impact that debt investing will have on our investors’ assets”, said a spokesperson of Nibble.

‘Debt investing is a smart strategy to diversify any investment portfolio’

The platform is working with Boostr to offer the investment portfolios. Boostr buys overdue loans from banks at auctions, with a discount of 85 percent. It automates the process of extrajudicial and legal recovery. “Thanks to the deep experience and technologies developed by Boostr, it is possible to achieve a high percentage of capital return.”

Comments