Best savings accounts in Europe

Instead of opening a local savings account, online you can easily find higher interest rates at banks abroad. The differences between a local savings account, and a high yield savings account in another country are often significant. Brokers and p2p platforms often offer even higher rates, but there are some risks to watch out for.

Content:

Interest on European savings accounts

Banks in other countries often offer higher interest rates on savings accounts than local banks. If you look beyond banks, the rates can be even higher. In Europe, there are many financial platforms, such as peer-to-peer lending and investment platforms. Some of these platforms offer products with fixed interest rates, which can be quite high.

Interest rates in countries like Spain, Poland or Estonia are often higher than other European interest rates. You could also start saving outside of Europe. But currency differences and economic or political developments sometimes pose risks. Therefore, we limit our overview to European banks and platforms.

High yield savings account in Europe

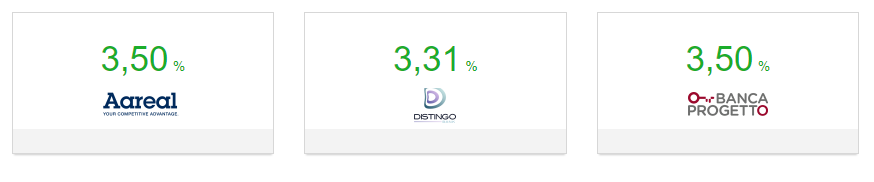

Online you can easily open a high yield savings account with several European banks. These often have a higher interest rate than what you receive in a local bank account. Some examples of banks with high interest rates are:

Term deposit with an interest rate of 3.4% per year for 10 years, or a savings rate of 2.7% for 5 years. Listed on the Borsa Italiana since 2015. Minimum deposit is 20,000 euro, maximum 100.000 euro. Covered by the deposit guarantee scheme. You can open your account easily through Raisin.

A small business bank based in Malta that focuses on digital and technology sectors. It offers up to 2.00 percent interest for a term of 1 years. Deposit from 20,000 to 100,000 euro. No tax and covered by EU guarantee. EU residents can open an account easily via Pickthebank.eu.

French bank, founded in 2013, it is part of a multinational car manufacturer. Offers savings products and financing or insurance for the customers (networks) of car brands such as Peugeot, Citroën, FIAT and Opel. Offers 2,01% interest per year. EU citizens can open an account easily via Raisin.com.

The banks listed above all offer good savings rates, and even as an international client it is easy to open an account there. If you are interested in getting the highest savings rates, you could also consider other institutions than banks.

Interest on investment accounts

If you are looking for the highest returns, you can also consider non-bank institutions. Besides bonds and other market products, more brokers now have their own options that allow you to earn interest on your balance or their products.

Offers various investment options for passive investors. European market leader in P2P lending with an average return of 11.3% on Core Loans. Also offers bonds, ETFs, real estate, and up to 2.25% via Smart Cash (available for instant withdrawal). Temporary 25 euro welcome bonus for new investors.

- The editorial team's preferred platform

- 11+ billion euros funded since its launch in 2015

- European market leader in P2P lending

- 50+ loan originators from 25 countries

- Wide selection of corporate bonds

- MiFID II license

Invest in over 1 million stocks, ETFs, bonds, and other instruments across U.S., European, and Asian markets. Explore predefined selections of high-yield ETFs and bonds with potential dividend returns of up to 6% in EUR. Utilize in-house market research and weekly investment ideas.

Invest through this European broker in stocks, ETFs, and crypto. Transactions in iShares ETFs and investment plans are free; other trades cost 0.99 euros. With Prime+ (4.99 per month), trades from 250 euros are free. Uninvested funds earn an expected return of 2.00%.

European p2p platforms

Both in and outside Europe, p2p lending platforms are booming. They often raise money from savers to lend out through small business and consumer loans. In return, you get a fixed interest rate on your investment. On these platforms, there is some supervision from governments, but it is not comparable to supervision that applies to banks. Popular European platforms currently include:

Offers various investment options for passive investors. European market leader in P2P lending with an average return of 11.3% on Core Loans. Also offers bonds, ETFs, real estate, and up to 2.25% via Smart Cash (available for instant withdrawal). Temporary 25 euro welcome bonus for new investors.

- The editorial team's preferred platform

- 11+ billion euros funded since its launch in 2015

- European market leader in P2P lending

- 50+ loan originators from 25 countries

- Wide selection of corporate bonds

- MiFID II license

Debitum is a rapidly growing Latvian p2p lending platform. It allows you to invest in financing for small businesses. With the auto invest function, you can easily spread your investments across multiple loans. The annual return often exceeds 10 percent. Regulated under a MiFID II license.

PeerBerry, located in Croatia, is one of the largest European platforms for p2p loans. Between 2017 and 2024, over 2,5 billion euros was invested on this peer-to-peer lending platform. It has almost 100K investors from more than 70 countries, with an average annual return of 10-12 percent.

Pros and cons of international savings accounts

Saving money abroad can have both advantages and disadvantages. These differ by bank, platform, country or (savings) account. Some advantages are:

Higher interest rates: Interest rates on savings abroad are often higher than at local banks.

Exchange rates: Do you conduct a lot of business in another currency? By keeping your savings in the same currency, you will not run currency risks. Conversely, a different currency can sometimes generate additional returns.

Financial privacy: Money abroad can offer financial privacy, although the rules for this vary widely.

Some disadvantages of saving abroad are:

Fraud and security: There is a risk of fraud or a security breach at any financial institution, and this risk may be greater at foreign banks with which you are less familiar.

Currency Difference: The currency of the country where you open a savings account may depreciate against your own currency.

Political and economic instability: The money you store abroad may be affected by political and economic events in that country.

Regulations: Countries have different rules and regulations for foreign bank accounts, and these can change. You may face legal risks, and many foreign platforms are not covered by the European deposit guarantee scheme for bank accounts.

Access to your money: Sometimes it can be more difficult to access your money quickly, especially if you have to deal with time zones and other logistical issues.

Taxation on savings abroad

If you open a savings account at a foreign bank, this can create complex tax issues. You may have to pay taxes in both your home country and the country where you save.

Savings products from foreign financial institutions are not always recognized as savings. For example, tax laws in some countries view savings at a p2p platform as an investment. It taxes the returns on this in a similar way as investments you purchase with an investment account at an online broker.

A foreign savings account at an unauthorized bank is taxed as an investment for income tax purposes.

Withholding tax

In addition, you face an assessment of withholding tax in many countries. This means that you also pay taxes in the country where your money is placed. Sometimes you can avoid or reduce double taxation with a statement showing that you pay your taxes in your home country.

You can also make sure your savings account is without withholding tax, by opening one in a country without such a retention tax, like Germany, Estonia, France, Italy or Sweden.

Frequently asked questions

Some frequently asked questions about the best high yield savings accounts in Europe are:

Which foreign bank has the highest savings rate?

In Europe, Renault Bank, Inbank and Nordax bank offer high savings rates. Interest rates can vary from day to day, making it difficult to say which bank offers the highest interest rate today. In addition, with some banks you run a currency risk or you may not be able to access your savings for long periods of time.

Are you considering other financial platforms in exchange for higher interest rates? With some large European p2p platforms, you can receive above 10 percent interest per year.

How can I open a savings account in another country?

Through Raisin Bank, you can easily open an account with many European banks. Both via desktop and an app on your mobile. You can also save abroad on p2p platforms. Please note: on some p2p platforms, you risk losing your deposit, and your money is only covered by the deposit guarantee scheme with an authorized bank from the European Union.